Belding: In fiscal cliff debate, what about the national debt?

Opinion: Belding 1/15

January 15, 2013

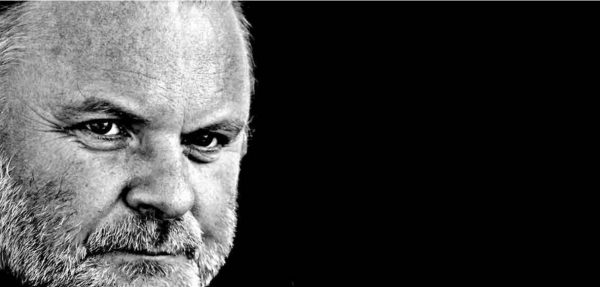

Exceptionally absent from the debate that surrounded the so-called “fiscal cliff” in the past few months, was the issue of the national debt, which stands at an unfathomable $16.3 trillion. That issue is inherent in the whole discussion of taxes, revenue, deficits, spending and the economy — and it is the public incarnation of those private problems — but the national debt, per se, consistently has been shoved aside in the rhetoric of Speaker of the House John Boehner and President Barack Obama.

Boehner alluded to the looming debt crisis in the speech he delivered Nov. 7, 2012, — the day after the election — saying the best solution to the cliff is “an agreement that begins to pave the way for the long-term growth that is essential if we want to lift the cloud of debt hanging over our country.” However, Boehner quickly moved on to reiterate a commitment not to an issue that the United States faces, but an issue that individual members of the United States face. Throughout his speech, Boehner touted his vision of a plan that would strengthen the economy. In turn, a strengthened, growing economy would lead to more revenues that would allow us to pay off the debt.

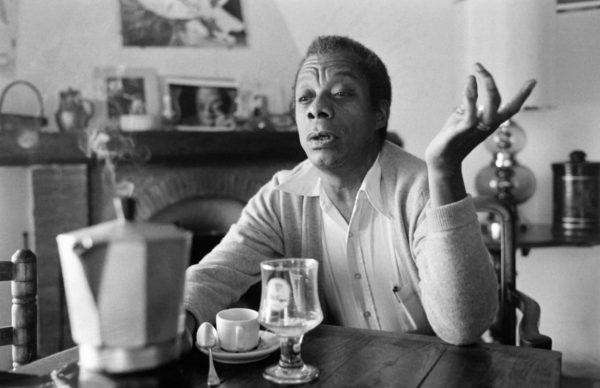

Obama replied in a speech two days later, on Nov. 9, 2012. The American people elected the victorious politicians, including himself, he said, “to focus on your jobs, not ours” — to focus on the jobs of the voting population. “Our top priority,” he said, “has to be jobs and [economic] growth.” He and Congress should work to avoid the fiscal cliff because “It would be bad for the economy and it would hit families that are already struggling to make ends meet.”

As the Jan. 1 deadline for enacting a solution to the cliff loomed, Obama delivered another speech in which he did not prioritized debt reduction but job security for jobs, government benefits and a few thousand dollars per year per family. He said the best solution was “a balanced plan that would … above all, protect our middle class and everybody who’s striving to get into the middle class.”

But the magnitude of our indebtedness is so looming now that we cannot afford to wait for our economy to grow. Taking out debt might be a prudent investment in the future, but allowing it to accumulate and shrugging it off is nothing less than reckless abandon.

Debt is more than a rain cloud hanging over the heads of those who owe money to others, especially when it is so large that paying it off in the foreseeable future (i.e. within the lifetimes of those Congressmen and women who voted for it) is next to impossible. Yet, the enormity of how difficult it would be to pay down the debt at this point in time, makes such payment all the more necessary.

Reducing the national debt is more important than creating pro-business or pro-consumer tax policy because, to the extent that a person — or a country — owes more money than it can immediately pay to its creditors, he coexists with them in the same relationship as a chattel slave exists to his or her master. In a country with a gross domestic product of $15 trillion that collects $2.57 trillion in revenue, our national debt clearly limits us.

Why is it so acceptable for us to live outside our means? For, clearly, that is what we are doing, in pledging away our national fortune. From Rome’s dealings with barbarian hordes to Great Britain’s relations with the United States in her desperate struggle to beat back Hitler’s Germany, taking on debt and paying tribute have been the ruin of nations.

Republics and democracies — of which the United States is one, I am told — are ruled by the people. Before John Adams became president, he defined a republic as “a government of laws, and not of men.” In our plan of government, no man or woman is above the law.

As the people live, so the government will live. And if indebtedness is a condition individuals should seek to avoid — think of how eager your parents are to pay off the mortgages on their houses, or how proud your grandparents were that they rarely used credit or how excited you are to pay off your car and student loans (and how much noise is given to reducing student debt, from student body presidents to the president of the United States) — why is it not a condition the whole country should seek to avoid?

I suggest that it is because we have failed to maintain a rigid discipline in what is, and is not, the purpose of government and politics. That will be the subject of my column next week.

——————————————————————————————-

Michael Belding is a graduate student in history from Story City, Iowa.