AT&T sets aside $4 billion for T-Mobile break-up fee

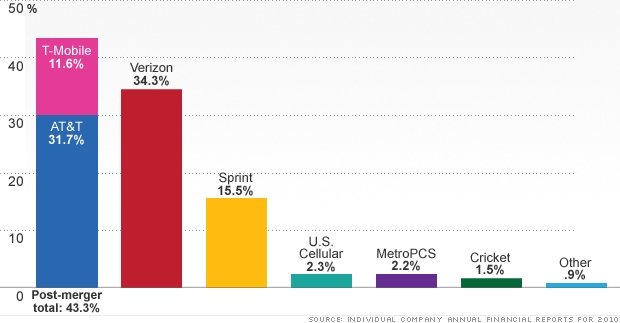

Graphic courtesy: AT&T via CNN Wire Service

If AT&T’s proposed merger with T-Mobile gains approval, AT&T would become the dominant provider in the wireless market.

November 25, 2011

In a sign that its merger prospects are dimming, AT&T said Thursday that it will take a $4 billion accounting charge this quarter to cover part of the break-up fee it will owe, if its bid to acquire T-Mobile fails to gain regulatory approval.

The move comes two days after the Federal Communications Commission took the unusual step of recommending that AT&T’s proposed $39 billion takeover of T-Mobile go to an administrative hearing. The maneuver, a sign of opposition to the deal, makes the FCC the second regulator to object.

The Department of Justice filed an antitrust lawsuit in August to block the merger. AT&T and Deutsche Telekom AG, the parent company of T-Mobile, are preparing to go to trial on the case in February.

AT&T also said Thursday that it is temporarily withdrawing its pending applications before the FCC. AT&T and Deutsche Telekom said they plan to focus first on overcoming the DOJ’s objections, and will refile their FCC applications if they obtain antitrust clearance for their deal.

That deal, which would wipe out the fourth-largest wireless carrier in the United States and make AT&T the market’s dominant player by far, now faces some daunting obstacles.

The FCC last called for a merger hearing in 2002, when it hit the brakes on DirectTV’s proposed merger with EchoStar — then the parent company of Dish Network. That proposal later fell apart in the face of strong regulatory opposition.

Recognizing that its deal is in jeopardy, AT&T said it will set aside $4 billion toward the whopping break-up fee it agreed to pay Deutsche Telekom if the deal couldn’t be completed. AT&T had agreed to fork over a $3 billion termination fee, and to forfeit several billion dollars more in wireless spectrum allotments.

AT&T snuck its bad news out on Thanksgiving, a day when U.S. markets are closed and few Americans are paying attention to business news. One lobbying group that opposes the deal, the Media Access Project, blasted the timing of the announcement.

“This turkey is too big to be hidden by releasing it on Thanksgiving,” said Andrew Jay Schwartzman, policy director of the Washington-based advocacy group. “Withdrawal of the FCC applications should be seen for what it is: a concession that the deal would create a duopoly in the national wireless market, that will result in higher prices and reduced choice in handsets.”

AT&T says it will continue pushing for the deal and working through regulators’ objections. Earlier this week, AT&T’s senior vice president of corporate communications, Larry Solomon, called the FCC’s decision to hold a hearing “disappointing” and questioned the agency’s rationales.

“It is yet another example of a government agency acting to prevent billions in new investments, and the creation of many thousands of new jobs at a time when the U.S. economy desperately needs both,” Solomon said in a written statement. “At this time, we are reviewing all options.”

— CNN’s Bill Mears contributed to this article.