Kruzic: We’re living in a corporate welfare state

Photo: John Andrus/Iowa State Daily

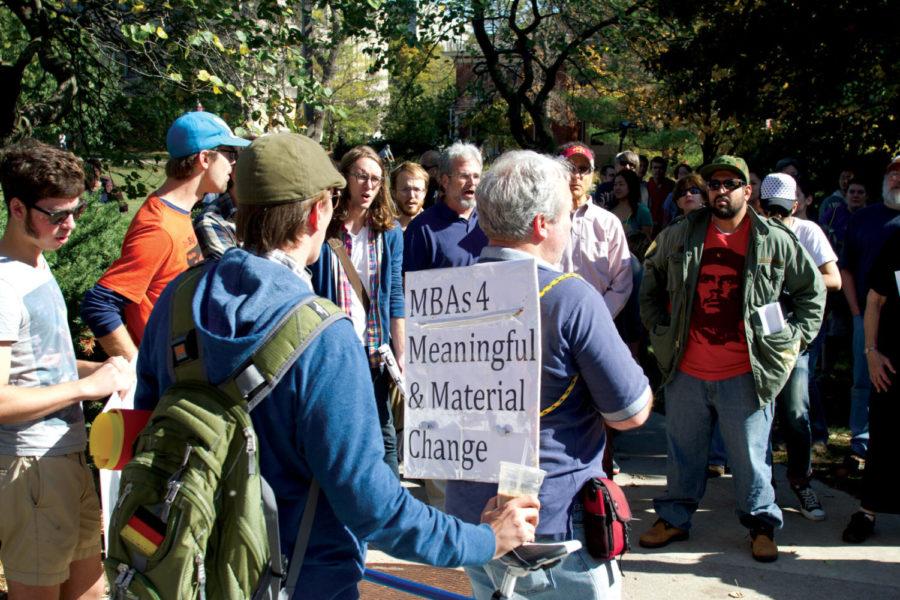

The Occupy Iowa event brought together an eclectic mix of protesters to the ISU Campus. They took turns shouting their concerns and then went on a march around campus.

October 20, 2011

In response to the extensive negative feedback

I’ve received for my previous criticisms of capitalism, I’d like to

articulate to the political right that happens to condemn my

progressive worldview — you are highly

inaccurate.

In fact, I am no longer criticizing

capitalism. I’m criticizing the socialism for the rich and free

enterprise for the poor that plagues the country; I’m criticizing

the fact that profits are privatized amongst an owning class of few

and risks and losses are socialized to the rest of

us. Yes, I’ll say it; we don’t live in a capitalist

welfare state any more. We live in a corporate welfare state.

Many prominent figures throughout history have

expressed fears of what now characterizes our current economic

system, realized the characteristics in recent systems, and spoken

against and offered solutions to our current system. History tends

to repeat itself; Andrew Jackson, seventh president of the United

States, said ” … I am convinced that you have used the funds of

the bank to speculate in the breadstuffs of the country. When you

won, you divided the profits amongst you, and when you lost, you

charged it to the Bank … thieves.” This idea was echoed by Robert

F. Kennedy Jr. when he remarked that our system is “socialism for

the rich and brutal capitalism for the poor.”

The notion of corporate welfare and privatized

profit (which is a result of socialized risk resulting in socialism

for the economic elite and free enterprise for everyone else) is

neither radical nor a new idea. We currently live in a system where

the profit is disproportionately held by an economic elite; 42.7

percent of our nation’s financial wealth is held in the hands of 1

percent of our population. Yes, nearly 50 percent of wealth is held

by 1 percent of the American population.

The economic elite shareholders of a

corporation disproportionately profit off of capitalism by

relegating risks of enterprise to the lower socioeconomic statuses.

This is made possible through decision makers whose campaigns are

funded by the wealthy; corporate welfare is received in the form of

taxpayer bailouts, deregulation and business-favorable rulings such

as Citizens United that serve to further the democratic process

from the average American.

A perfect example of corporate welfare is the

well-known “Wall Street Bailout.” The pledged

$633,575,722,738 infusion of our money into Wall Street was

intended to keep private banks afloat following the crisis of 2008.

Investments were bought with shaky loans; investment firms relied

too much on borrowed money. Just like many average Americans, the

investment institutions didn’t have enough cash to withstand the

decrease in mortgage-pertaining investments when the housing market

slumped. Simplified, the American taxpayer was buying toxic assets

from private banks who had bet a bit too riskily; the idea was to

keep the private world of finance afloat.

The only problem: When I bet riskily, I don’t

get a bailout — and neither do you. Neither did American consumers

when they were duped into mortgages from predatory lending

practices resulting from lack of regulation.

Though some argue it was necessary to the

economic vitality of the country, others say the bailout was

excessive and lacking necessary regulation to be sure the parties

using taxpayer money were doing so responsibly. While CEO pay is at

its highest and profits continue to rise, the corporations have not

paid back America.

Thus far, $579,952,314,483 has been dispersed

to banks and mortgage servicers as part of bailout packages.

Bank of America subsidiaries have been given

$220 million so far, and $8 billion total will be dispersed; they

have returned $0 in bailout money and contributed $0 in revenue as

a result to the U.S. government. Bank of America’s CEO is

compensated $16,000,000.

Wells Fargo Bank, N.A. has been given $192

million so far, and $5 billion total will be dispersed; they have

returned $0 in bailout money and contributed $0 in revenue as a

result to the U.S. government. Wells Fargo’s CEO is compensated

$21,340,547.

A perfect case study: JPMorgan Chase. JPMorgan

Chase subsidiaries have been given $247 million so far, and $4

billion total will be dispersed; they have returned $0 in bailout

money and contributed $0 in revenue as a result to the U.S.

government. During the fourth quarter of 2010, the

company made a profit of $52,000,000 per day — yes, that’s per day.

This figure even includes days they weren’t in business. The CEO of

JPMorgan Chase made $27.8 million in compensation last year. To

reiterate: JPMorgan Chase has repaid $0.

In addition to the taxpayer bailouts

contribution to our socialist safety net for the obscenely wealthy,

there are many instances of legislation passed that deregulates the

business world to increase profit at the expense of everyday

Americans and their health, homes, communities and

livelihoods.

For example, the BP oil spill tragedy can be

directly linked to a round of cost-cutting measures aimed at

increasing profit by $3 billion and government deregulation that

allowed the cost-cutting measures to occur. As oil-producing

countries such as Norway and Brazil require “acoustic switches” on

off-shore oil rigs to prevent tragedies, the BP rig did not have

one; according to industry officials, the switch would have cost

the company $500 million (pocket change to an oil giant such as

BP).

The U.S. government looked into requiring the

switch a few years before the spill; however, the Interior

Department’s Minerals Management Service decided not to require the

measure. The Mineral Management Service said in a report that

“acoustic systems are not recommended because they tend to be very

costly.” BP has reported $14 million in profits.

The estimated economic impact on industry in

the region as a result of the spill: $4.3 billion; this

disproportionately impacts small business owners such as fishermen,

restaurants and tourism. BP couldn’t be proactive

enough to spend $500,000 to prevent $4.3 billion in damages? This

figure doesn’t include the horrifying long-term impacts such as

ecosystem vitality and health concerns for residents exposed to

increased levels of chemicals.

We must ask ourselves: Who is benefitting from

policies such as these? Who is benefitting from the

free-market rhetoric? This rhetoric fed to Americans justifies

imposing economic risk on lower socioeconomic classes while

allowing the corporate elite to insulate themselves from risks of

the market by way of leveraging economic and political advantages

enabled by their wealth. As Noam Chomsky would say, “The free

market is socialism for the rich, markets for the poor and state

protection for the rich.”