Ward: We shouldn’t tax the Internet

Richard Martinez/Iowa State Daily

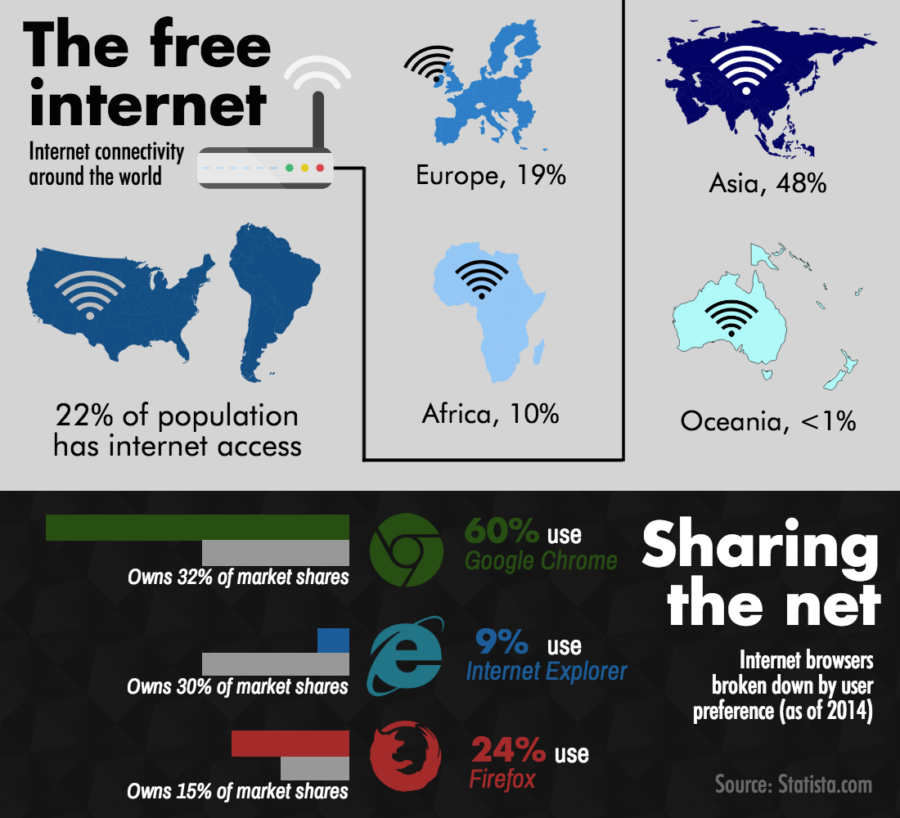

On average, only 40 percent of the world’s population has Internet access. In some locations, populations have significantly poor accessibility. Internet browsers like Google Chrome, Internet Explorer and Firefox are commonly used but have contrasting control over who has access to their services worldwide.

December 8, 2014

Ever since the conception of the Internet, it has permeated every facet of our lives in ways its creators couldn’t have imagined. The Internet and all the ways we have become accustomed to using it have resulted in an increase in the amount of information available for public disposal, ease in communication and even introduced some of today’s biggest celebrities.

The Internet has evolved from a very static “bulletin board” of sorts to more of a malleable resource being shaped and molded by everyone who logs on. One of the most beautiful aspects of the internet is the countless contributions being made to this once blank canvas.

Anyone at any time has the ability to shift the current design on the internet because we have the freedom to do so. However, in a few short days that freedom will be coming to an end with the lifting of the ban on taxing for internet services.

The Internet Tax Freedom Act was passed Oct. 21, 1998 by President Bill Clinton in order to allow Internet users to add to, learn from and improve the Internet while it was in its infantile stages without being penalized with a tax. As a result of this act, it prevented local, state or federal governments from imposing a tax on internet users.

It should be noted that this act excludes sales tax on items purchased online. Just like in stores, there is still a tax for the purchase of anything online. This act has been active for just shy of 20 years and has clearly created numerous benefits, because over its lifespan, it has been extended four different times.

The most recent extension was made by President Obama on Sept. 19, 2014, only three months prior to the end of the act on Dec. 11.

Taxes in this country on various aspects of essentials for day-to-day living are nothing new, whether we know exactly how much we are paying or not. Obviously, there is a visible sales tax on things you buy in stores, you can see it right on the receipt, but what about the other taxes we never even thought about like in a cell phone bill.

Even though cell phones are now a convenient platform for the Internet, the Internet Tax Freedom Act does not apply to mobile devices and the services along with them. Because I don’t pay my own cell phone bill, I have no idea what fraction of the bill applies to, including how much of the bill is actually a government tax. According to CNN, the average cell phone user will pay 17.1% of their bill in taxes.

The tax on cell phone services is also very similar to the taxes placed on cigarettes with only a slight variation. However, the tax on cigarettes raises the price of them in hopes of discouraging their use, so it’s not a stretch to guess that a similar effect will take place with the tax on the Internet, except the government isn’t trying to dissuade people from shaping the World Wide Web.

If a tax were in fact placed on this public resource, the most stand-out result would be a more narrow audience able to afford to add to and cause the internet to evolve, thus resulting in a specific type of information being presented.

As a whole, the media is already skewed based on which wing of the government the outlet sides with and how they present the news to us, so if a funnel was placed on the Internet, it would only further shave off thoughts and opinions of those who perhaps cannot afford to pay the extra tax for the use of the once completely public, malleable internet.