Lecture gives historical perspective on importance of a central bank

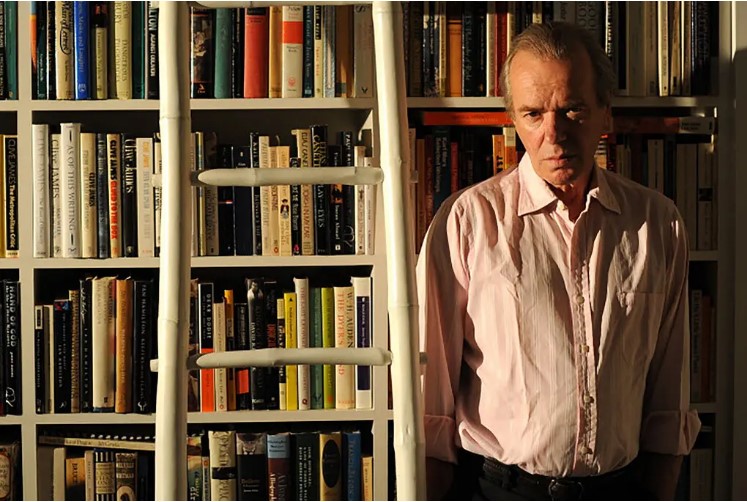

Gillian Holte/Iowa State Daily

David Weiman, a professor of economics at Barnard College, visits with ISU professors before his lecture “Main Street versus Wall Street: A Historical Perspective.”

March 30, 2017

Banking panics have been an inherent part of the American experience and lead to many developments and changes in the way banks are regulated.

David Weiman, professor of economics and faculty director of the Empirical Reasoning Center at Barnard College, presented his lecture “Wall Street v. Main Street in Historical Perspective: The Panic of 1907” on Thursday about the history of the banking panic that led to the creation of the Federal Reserve.

His historical look at the events leading up to the creation of the Fed focused on the importance of having a central bank and why it is still significant more than a hundred years later.

“The purpose of this talk is to explain to you why we have a federal bank,” Weiman said. “Oftentimes we lose sight of that because we take for granted the sort of protections and the foundations that establishes the secure and relatively stable fluid economic expansion, as we remind ourselves by trying to imagine the experience of when there was no central bank of the United States.”

In 1907, the American banks were extremely localized and dependant on a system of correspondence.

“There were over 21,000 banks in the United States in 1907,” Weiman said.

This system of localized banks worked well during normal periods, but a banking panic like the one in 1907 showed the limitations of the system.

“The panic actually had such devastating effects on the monetary system, this fragmentation of the monetary system, but it also showed the limitations of the kind of private, somewhat deregulated banking financial system,” Weiman said.

This banking crisis brought about the realization that something needed to change to create a more stable system. This was achieved by creating the Fed, a central bank that could intervene when needed.

The message from the 1907 crisis is that private fragmented banking systems can operate very efficiently during the normal times, but during abnormal times, you need the federal bank to come to the rescue, Weiman said.

We can make ourselves complacent that we don’t need central banking or we don’t need regulatory infrastructure, and that is true when the economy is running along smoothly. But it is clear like in 2007 and 2008 when the crisis hit that the Fed and federal government are needed to bail out the banking system, Weiman said.

Weiman specializes in 19th and 20th century American economic history, the political economy of contemporary U.S. criminal justice policy and the history of economic thought, according to Barnard College. He was awarded the 2014 Jonathan Hughes Prize for Excellence in Teaching Economic History, according to Economic History Association.

This event was part of the 2016-17 National Affairs Series: When American Values Are in Conflict and the Phi Beta Kappa Lecture, according to the ISU Lectures Program.