Editorial: Don’t let Black Friday gobble your money

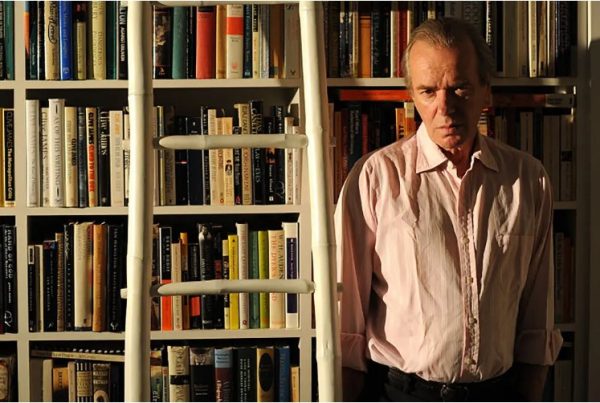

Photo: William Deaton/Iowa State Daily

Shoppers rush into Target when the time reached 9 p.m. in Ankeny, Iowa, for the beginning of the Black Friday Sale on Nov. 22. Target decided to open its doors at 9 p.m. Thanksgiving night instead of at its usual time of midnight.

November 21, 2014

The flyers that line our newspapers and spam our emails are hard to ignore. The deals they contain are so irresistible. They draw us to wait in lines for up to eight hours, and some even overnight. According to Business Insider and CNN Money, there were 12.3 billion dollars in sales for Thanksgiving and Black Friday last year alone. You could say that it’s a time of year when we let that extra cushion of money lining our wallets fly away and go toward that new TV or better gaming system.

Target, Walmart and other super stores have already released their Black Friday deals, which promote many high-dollar electronics and appliances for up to 50 percent off normal retail. These deals draw hundreds of people out of their warm and cozy homes into the harsh weather with wind chills below zero sometimes.

With all these deals available, do we really need to spend hundreds of dollars on these late night extravaganzas? The holidays are a time of year when money gets tight. This year’s average amount to spend on dinner, decorations and other items is up five percent, at a total amount of $804.42. With over 800 dollars in spending for entertaining your family and guests, while also providing for your own family, the extra Black Friday spendings don’t always seem so smart. Last year, the average amount spent on Black Friday and pre-Black Friday shopping was $407.02.

All this extra money on Black Friday can put a damper on one’s budget and bank account. Risky spending isn’t always a good idea, especially for the average family. Black Friday promotes this risky business, and that’s exactly what businesses want when they spend millions on flash, mail, online and over-the-air advertising. Businesses like Target and Walmart want you to spend money when they say “limited quantity” and “available while supplies last.” We can’t resist their calls to action when the thought of scoring a good deal is on the table.

Impulse buying plagues us all, but we don’t need to let it affect the holiday cheer and family dinner time. Spending time with family and enjoying what we have is good enough. Instead of buying that new TV, why not just stay home and enjoy what’s already there? Be wise to what is placed in front of you and think before you buy.

Just because it’s 50 percent off doesn’t mean we need to risk that cushion lining our wallets. But not all deals out there are considered risky. That new oven could be a good addition to your home when your old one has been spewing smoke for weeks. Some of the deals offered are great and worth investing in, but some thought should always be taken into consideration.